China and the Fed will tame Obama spending

Barack Obama might finally have met his match. Two matches, in fact. No, some new Republican opponent has not emerged to threaten this enormously popular president with a difficult campaign for re-election.

No, Republicans in Congress have not produced a coherent alternative to the president’s deficit spending programmes, or his plan to move the boundary between the public and private sectors to the left. And no, the economic data do not suggest that the president’s stimulus package has failed.

Indeed, the housing market is showing signs of bottoming out. Pending house sales (deals signed but not yet completed) rose 6.7% in April, the biggest jump in more than seven years. Consumer confidence, personal disposable income and construction spending are all up, and monthly job losses have halved. Builders are more active. The index of manufacturing activity is rising. As Federal Reserve Board chairman Ben Bernanke told Congress last week: “We continue to expect overall economic activity to bottom out, and then to turn up later this year.” Finally, the banks are raising new capital ($85 billion in the past month alone) so they can repay the government bail-out loans.

So if it is indeed, “the economy, stupid”, as Bill Clinton’s adviser James Carville once contended, the president’s popularity ratings should remain stratospheric, at least in the near term. The long-term challenge to the president (leave aside a possible fiasco in Afghanistan) comes from two related places: the bond markets and China.

Carville came to realise that Democrats could not borrow and spend to their hearts’ content. The bond markets wouldn’t have it. Improvident fiscal policy would drive up interest rates, slowing the economy.

Treasury IOUs are flooding the market to finance deficits that by White House estimates will take the national debt from 40% of GDP to 70% (the Congressional Budget Office puts the figure at 80%) by 2011, the highest level since the second world war. Throw in the printing of money to support the Fed’s efforts to prop up credit markets and investors have good reason to fear inflation and a decline in the value of the dollars with which the government will repay their loans. So they are driving up long-term interest rates. And dumping dollars.

If those trends continue, the green shoots will wither as higher rates abort the housing recovery, and make it more expensive for businesses to make job-creating investments. Bernanke told Congress that “we, as a nation, [must] begin planning now for the restoration of fiscal balance . . . [that] will require a willingness to make difficult choices”. This can only be interpreted as a warning to the administration that if it doesn’t get the deficit under control, the Fed will start contracting the money supply and allow interest rates to rise. Just how the president and Congress can be persuaded to make those “difficult choices” remains unclear.

Perhaps that friendly persuasion will come from the folks who, like the Fed, pose a threat to the Obama agenda: the Chinese who are sitting on about $1.4 trillion of America’s IOUs. On last week’s trip to China, Tim Geithner, the Treasury secretary, was greeted with derisive laughter when he assured students at Peking University that “Chinese assets are very safe”. Their elders were more polite. Guo Shuqing, chairman of the China Construction Bank, helpfully noted that the dollar will remain the world’s reserve currency “in the short term” because the American “economy is No 1 in terms of competitiveness, in terms of innovation”. Longer-term prospects are being made clear by Chinese officials who are warning that unless America puts its fiscal house in order they will seek to reduce the role of the dollar in world trade and will not buy IOUs at anything like current interest rates.

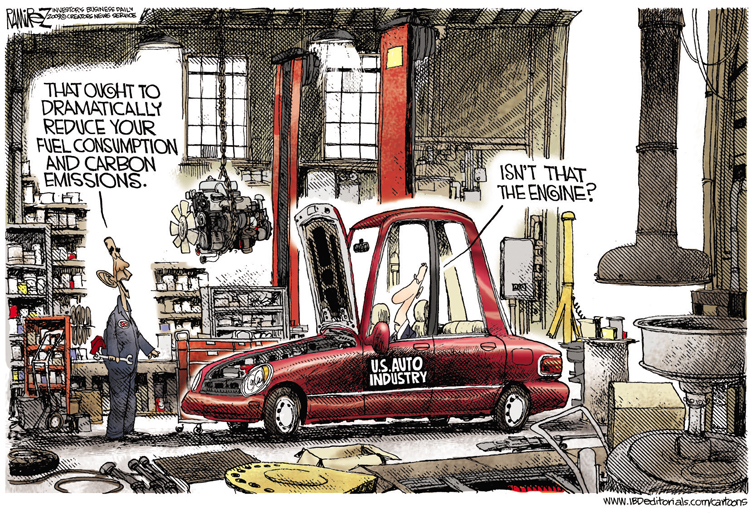

All this means that Obama’s White House team will have to make the “difficult choices” Bernanke is calling for, and the Chinese are demanding, if it is to avoid a recovery-dampening rise in interest rates. Stimulus spending is one thing, justifiable to fight the recession. Running a deficit of 13% of GDP to fund the Democratic wish list of new entitlements and the reconstruction of the energy and healthcare sectors is red ink of a deeper hue.

So Obama will have to make two deals, one with the Fed and one with the Chinese. That means developing a credible programme of deficit reduction once the economy is recovering and satisfying the Fed that he really, really means it. There are only two ways the president and the Congress can do that: cut spending or raise taxes. Obama is deeply committed to what he considers to be a necessary transformation of the entire economy: government healthcare insurance for all; billions spent on clean energy and other anti-climate-change measures; university education for all. My guess is that his first choice will be to increase taxes, perhaps in the form of a national sales tax aimed primarily at “the rich” by exempting low earners.

If that doesn’t produce enough revenue, ongoing inflation-producing deficits will trouble him less than abandoning his dream of joining Lincoln and Roosevelt as “transformational” presidents.

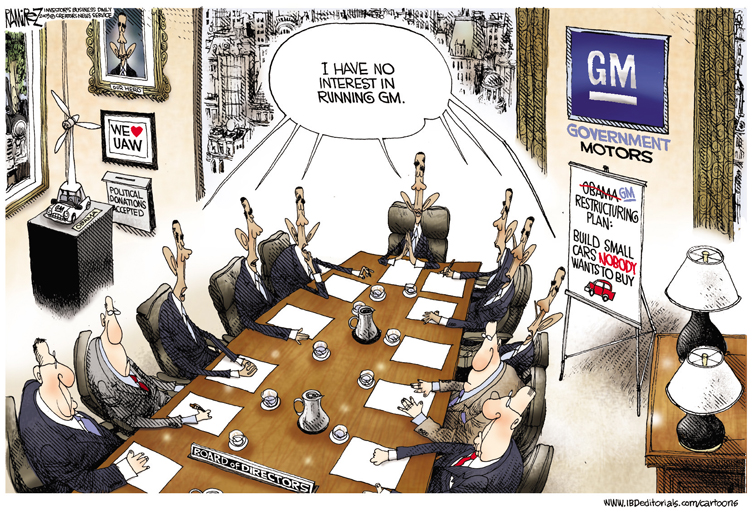

As for China, a mutually beneficial deal is in the works. America will reduce its deficit somewhat, press international institutions to assign a larger voice to China (a matter of power and “face”), and back off on all that human-rights talk and on support for Taiwan. China will continue to buy and hold American IOUs, not demand the creation of an alternative international reserve currency, and allow its currency to rise a little to reduce its exports to America and relieve Obama of some of the protection- ist pressure that has already generated a ban on the importation of small cars from China by General Motors.

Imperfect, but at least a recognition by China and America that economic growth and stability depends on this G2 reaching a mutual accommodation.

Irwin Stelzer is a business adviser and director of economic policy studies at the Hudson Institute

No comments:

Post a Comment